Key Takeaways

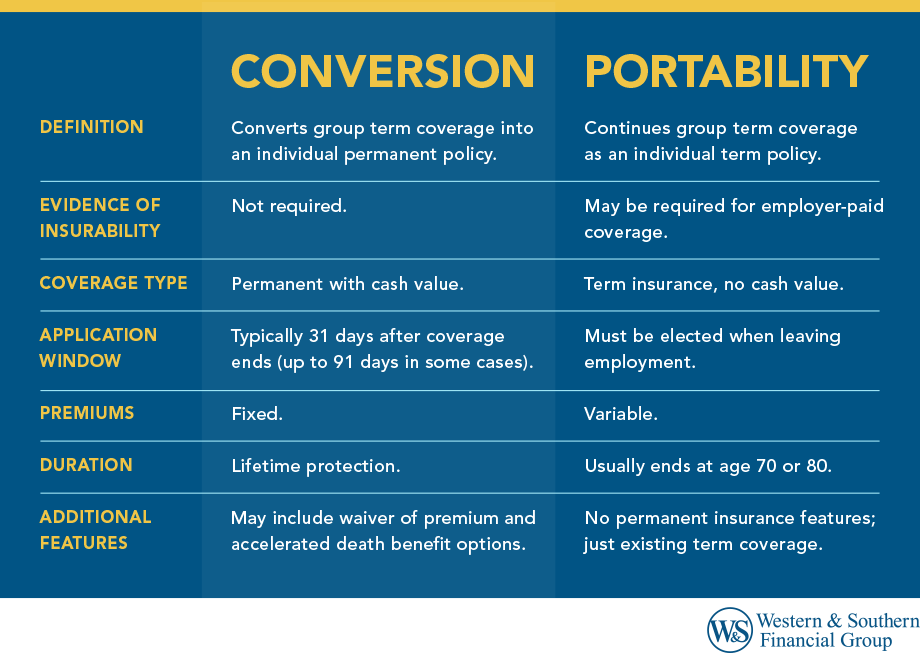

- Group life insurance usually ends when you leave your job, but conversion and portability options can help maintain your coverage.

- Conversion allows you to turn your group term policy into a permanent life insurance policy without taking a medical exam.

- Portability lets you continue your group term insurance as an individual term policy, but it usually ends by age 70 or 80.

- You must act quickly to apply for conversion or portability or risk losing your coverage altogether.

- Choose conversion if you need lifelong coverage or have health issues, and portability if you want lower initial costs or short-term protection.

When you leave your job, your employer-sponsored group life insurance typically ends immediately. However, most group plans include valuable conversion and portability features that allow you to maintain coverage without starting from scratch.1

Understanding these options can mean the difference between continuous protection and leaving your family financially vulnerable.2

What Is Group Life Insurance?

Group life insurance represents a fundamental employee benefit, typically offered as term coverage to employees who meet eligibility requirements. Unlike individual policies, group coverage is negotiated by your employer and usually comes at significantly lower premiums due to collective buying power.

Statistics show that 30% of Americans with life insurance are only insured through a group plan, making conversion and portability options particularly critical for millions of workers.3 The coverage amount often ranges from one to five times your annual salary, with automatic termination when employment ends.

When Do These Options Become Available?

Your right of conversion provision or portability option typically activates when you experience:1

- Termination of employment

- Reduction in work hours below eligibility threshold

- End of leave of absence

- Retirement

- Employer discontinues the group plan

- Reduction in coverage amount

The No-Medical-Exam Advantage

Perhaps the most valuable aspect of conversion is avoiding medical underwriting. You can secure coverage without submitting to medical exams or completing health questionnaires.4

This proves invaluable if you've developed health conditions during employment. For example, a 47-year-old with a cancer diagnosis may still secure coverage through conversion, a benefit often unavailable in traditionally underwritten policies.

Similarly, someone with a newly diagnosed heart condition maintained $300,000 in coverage when changing jobs, despite a condition that would have made standard underwriting prohibitively expensive.

Hypothetical example. For illustrative purposes only.

Understanding Maximum Coverage Amounts

Both options have limitations:

Conversion limits:

- Cannot exceed the amount terminating under the group plan1

- Some carriers impose maximums (often $500,000)4

- May convert both basic and voluntary coverage

Portability limits:

- Typically limited to voluntary coverage amounts

- Basic employer-paid coverage may require evidence of insurability to port

- Age reductions in the group plan usually apply4

AD&D Coverage & Additional Benefits

If your group policy included AD&D coverage, you may purchase an accidental death benefits rider for your conversion policy, with coverage ranging from $25,000 to $500,000, though it cannot exceed your total life insurance coverage amount.4

Other benefits to consider include accelerated death benefit provisions for terminal illness and waiver of premium riders that continue coverage without payments if you become disabled. Payment of accelerated death benefits if not repaid will reduce the death benefit and affect the other policy values.

The Application Process: Step-by-Step

Successfully transitioning your coverage requires prompt action:

- Immediately locate your certificate of coverage outlining your specific conversion and portability provisions, including deadlines and maximum coverage amounts.

- While ERISA doesn't automatically require employers to distribute life insurance conversion notices, many group policies specifically assign this responsibility to employers.5 Contact your benefits department or insurance company proactively.

- Applications typically arrive by mail and must be completed within 31 days of receiving the packet. Request these immediately.

- Determine whether you want additional riders like waiver of premium or accelerated death benefit options during initial application for waiver of premiums.

- Your first premium payment must accompany the application and be received within the deadline. Late payment voids your rights.

Important: During the conversion period, if you die before completing the conversion, the insurance company will pay the amount for which an individual policy could have been issued.

Common Mistakes to Avoid

- Assuming notification: Court cases have established that employers don't always have explicit ERISA obligations to notify employees of conversion rights.

- Missing deadlines: Even one day late permanently eliminates your options.

- Not comparing options: Evaluate both conversion and portability against individual market options based on your health status.

- Forgetting dependents: Covered spouses and children may also have conversion rights requiring separate applications.

ERISA Protections & Legal Considerations

The Employee Retirement Income Security Act governs most employer-sponsored group life insurance plans.5 Recent court decisions highlight proper notice importance.

In Estate of Foster v. American Marine Services Group Benefits Plan, the Ninth Circuit ruled that providing only certificate of coverage and summary plan description documents didn't satisfy employer notification duties for a terminally ill employee.

Another case resulted in a $750,000 judgment against an employer who failed to adequately explain conversion options to a terminally ill employee, despite multiple inquiries about maintaining benefits.

Making Your Decision: Conversion or Portability?

Choose conversion when:

- You have health conditions making traditional underwriting difficult

- You want lifetime coverage beyond age 70

- Building cash value appeals for future financial flexibility

- You can afford higher premiums for guaranteed level rates

Choose portability when:

- You're relatively healthy and may qualify for competitive rates later

- You need temporary coverage between jobs

- Budget constraints make lower premiums essential

- You expect to secure new employer coverage soon

Choose individual underwriting when:

- You're in excellent health

- Comparison shopping reveals better rates

- You want more customization options

Conclusion

Whether you choose to convert your group life insurance or port it, understanding your options and acting quickly can help you maintain coverage when it matters most. By weighing your health status, financial goals, and future needs, you can make a decision that supports your long-term protection, without gaps in coverage.2 Always review your group policy details, ask questions, and don’t wait until it’s too late to act.

Discover how you can keep your life insurance through conversion and portability options in group plans. Request a Free Life Insurance Quote

Frequently Asked Questions

Can I convert just part of my group life insurance coverage?

What happens if I die during the conversion period?

Does group life insurance conversion require evidence of insurability?

Can I port my life insurance if I'm disabled?

How long does portability coverage last?

Will my premiums increase with portability?

What if my employer didn't notify me about conversion rights?

Can I add more coverage when converting or porting?

Sources

- Understanding Life Insurance Conversion & Portability – NIS Benefits. https://blog.nisbenefits.com/understanding-life-insurance-conversion-portability.

- U.S. Life Insurance Need Gap Grows in 2024 – LIMRA. https://www.limra.com/en/newsroom/news-releases/2024/u.s.-life-insurance-need-gap-grows-in-2024/.

- Life Insurance Statistics in 2025 – The Zebra. https://www.thezebra.com/resources/research/life-insurance-statistics/.

- Continuing Group Life Insurance – Prudential Financial. https://www.prudential.com/personal/workplace-benefits/group-insurance/converting-group-life-insurance.

- ERISA – U.S. Department of Labor. https://www.dol.gov/general/topic/health-plans/erisa.